NEW GOLDEN VISA PROGRAMME for PORTUGAL

Recap: In February 2023 the Prime Minister of Portugal announced the intention to close the Golden Visa Programme as part of a general proposal related to housing called ‘Mais Habitação’ or ‘More Housing’ bill. After months of discussions and various stages of votes the programme will remain but with some changes

The most significant change removes real estate in all forms from the list of eligible Golden Visa qualifying investment. Importantly, those in the programme or with a valid application pending under a previously acceptable route will be ‘grandfathered’ under the old law.

Moving forward, market consensus is that there will be an increased interest and focus on Golden Visa qualifying investment funds, an area EQTY clearly has believed in over the last 3 years and we find ourselves well placed to expand off a very solid foundation.

History: The programme has a legacy of evolving yet importantly always protecting those that have qualified under a previously eligible route. For example, in 2021 when EQTY launched, €350,000 was the required amount for a potential applicant to be qualified under a fund investment. This subsequently increased to €500,000 from 1 January 2022 yet those still waiting for Golden Visa approval under the old laws were duly processed. This will rightfully occur again for investors who have pursued one of the soon to be disqualified options.

President Marcelo has finally ratified the proposed "More Housing" legislation. The end of the existing programme is imminent and will come into force when published in the official government gazette (in 2 to 8 days).

New Investment Options:

Despite the confirmed amendments, the changes have given rise to new opportunities for Golden Visa purposes, offering much potential.

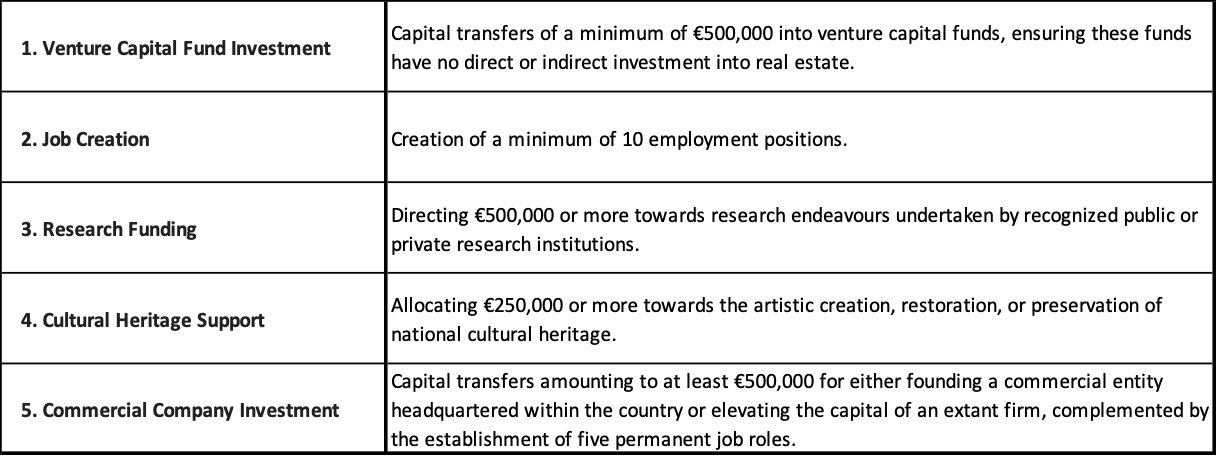

These investment options are:

Future Prospects:

The revised orientation towards the Golden Visa Programme aspires to stimulate a broader spectrum of investment activities, introducing new opportunities while preserving the programme's allure. Investing into a venture capital fund has increased in attractiveness and can offer a variety of options for investors to choose from. The fundamentals of a commercially sound product alongside a strong team, purpose and realistic objectives will be more pertinent than ever as new players and funds emerge.

We will keep you updated and informed as this landscape evolves and as with everything, in this ever-dynamic time, change is always accompanied by exciting and new opportunities.